Checks normally specify the person’s name or the company that should receive the amount of money indicated on it. But some checks do not have a specific name but instead have the phrase “Pay to the order of cash.” What does “Pay to the order of cash” mean?

A check indicating “Pay to the order of cash” means that it can be cashed or deposited by anybody. So a check with this phrase doesn’t need to have a specific name for it to be cashed by an individual.

When the word “cash” is written on the check instead of a name, it means the bank is obligated to give the amount indicated to anyone who presents it.

Checks made out to “cash” are just like any other legitimate check that banks are required to honor. Writing “cash” on the check instead of a specific name is convenient for issuing a check if you don’t know who to make the check out to.

Read on to learn more about the meaning of “Pay to the order of cash” checks, its attendant risks, why it is used, and how you can write one.

Pay to the Order of Cash

A check labeled with ‘Pay to cash’ means that anybody can cash or deposit it. You may opt not to write a specific name of a person or organization every time you issue a check.

If the word ‘cash’ is written on the check instead of a name, the bank where it is presented is obligated to give the amount indicated therein to the person who presents it.

The phrase ‘Pay to the order’ is commonly written on negotiable checks or drafts paid via an endorsement identifying a specific name or organization that the check holder has authorized to receive the amount of money.

Sometimes, checks have the phrase ‘Pay to the order’ or ‘Pay to order,’ followed by ‘of cash.’ If someone presents this type of check to cash or deposit it, the bank teller and the bank have no right to refuse the request and process it accordingly.

When writing a check, you can choose not to specify the person or organization that gets the money. It is a convenient way of writing a check if you are unsure who will really receive the money. However, writing a check this way is risky.

This kind of check will have the word ‘cash’ written on the payee line. Of course, if you pay a person whose last name is Cash, you would write it after his first name. A check written to cash is just like that – cash. Just anybody can cash it out.

And that’s the danger with these types of checks. If a ‘cash’ check gets lost, the person who gets the check can cash out the sum of money indicated on the check. The money goes to another person instead of the intended recipient.

Risky Nature of the Pay to Cash Check

This type of check bears the word ‘Cash’ on the payee line. Normally, checks are written with the person’s specific name or organization that should receive the money. With ‘Cash’ checks, just anybody who presents them to the bank is entitled to the proceeds.

Checks with the payee’s specific name are safer than checks written to ‘Cash.’ If you specify the name of the payee, you are sure that the person will receive the money. Not just anybody can cash or deposit this kind of check.

A ‘pay to cash’ check is the same as a ‘pay to bearer’ check. Anyone who bears the check will cash or deposit the check in the issuing bank or deposit it in his own bank. As the check’s writer, you have no control over what the bearer chooses to do with the check.

Why Do You Need to Write Pay to the Order of Cash Check?

There are several reasons why a business person or somebody who has plenty of money will write pay to cash check:

1. To Conceal the Paper Trail

Sometimes, business people feel the need to cover their transactions for one reason or another. Thus, they conceal their payee by writing a cash check instead of a standard check. Upon cashing out, the official bank records will not reveal the person who took the money.

Thus the businessman will balance his finance conveniently since the records show the money deducted from their account without specifying the actual recipient.

2. To Write a Check to Yourself

You can also issue a pay to cash check if you want to withdraw money from your bank. However, it is much more convenient to just go and use your ATM or debit card on an ATM machine to withdraw cash if you know you have money in the bank.

I’m saying here that you can use the pay to cash check strategy for fund transfers. If you want to transfer your money from one bank to another bank, you can also do it by writing a cash check. But you can also do this task electronically.

3. To Pay Someone You Don’t Know

You can also write a cash check to someone or to an organization that you don’t know. For instance, you know you have to pay someone, but you are not sure of his exact name, then you can write a ‘Pay to Cash” check.

Most banks will ask the check’s bearer to present their I.D. for verification before releasing the amount indicated on the check. So, if you can’t spell their name, write ‘Cash’ on the check, and the person who presents the check will get their money.

Risks of Making Pay to the Order of Cash Checks

Below I listed some of the risks when you use a pay to the order of cash check:

1. Loss or Theft

Since anyone can cash pay to cash check, you need to be careful in issuing it. The risk is not so much with you but with the recipient. If they lose the check, they will lose the money as well.

If you are paid with pay to cash check, guard it with all your life – especially if it is a good amount. To safeguard the check, if possible, give the check to the payee when he is ready to cash it or deposit it in his bank.

2. The Bank Might Not Accept It

While most banks accept and honor pay to cash checks, some banks don’t. In most banks, they will first call the person or company who issued the check.

The banks are just making sure that they will release the money will not get into the wrong hands. They will often call the issuer of the check to confirm if they really have issued the check with the specified amount.

3. The Process Takes Time

The bank teller will also ask the person cashing out the check to present an I.D. so that they can write the name down on the back of the check and have the person sign it. As you may have predicted, the whole process takes time.

Again, when you see on a check “Pay to the order of cash,” it means you can cash this check or deposit the money specified on the check. The bank is required to deposit or give the amount indicated therein to anyone who presents it.

How to Write a Pay to the Order of Cash Check?

How do you write on a check “Pay to the order of cash”? Below I listed the steps:

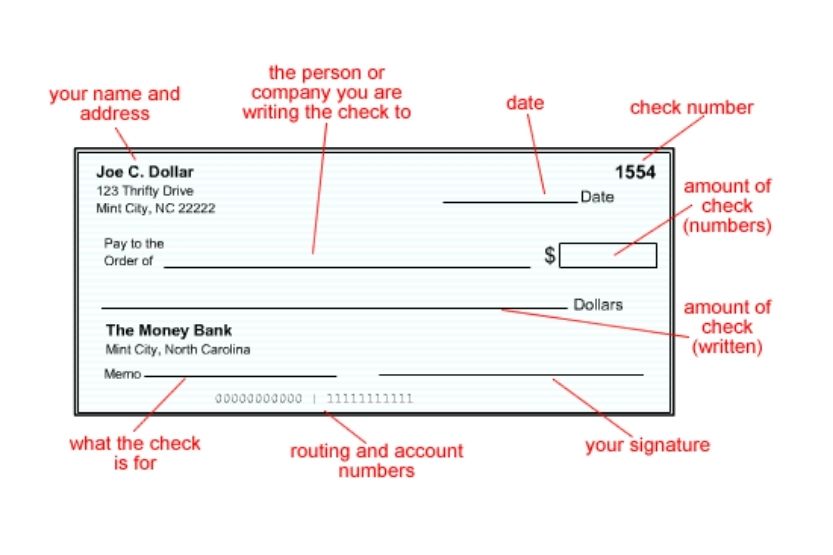

1. Specify the Date

The first thing you need to do is to date the check. Normally the space for the date is at the top right corner of the check. Write the date in Month, Day, and Year format. To make this more convenient, you can abbreviate the month.

2. Write “Pay to Cash”

On the payee line, write “Pay to Cash,” or “Pay to the Order of Cash,” or if the check already has the word “Pay to the order of,” just add ‘Cash.’

3. Write the Amount

The next step is to write the amount of money in words, with a $ sign before the number. There should be a line or two below the payee line where you should write the amount.

There’s also a space in the check that is enclosed by a parenthesis. On most checks, a dollar sign is already printed inside the parenthesis. All you need to do is write the amount in numbers inside the parenthesis.

Be careful about the numerical digits. Ensure that the amount in words is the same as the amount in numbers.

It is essential to write ‘XXXX’ after the written amount in words so that no one can add to the amount of money that you have already indicated on the check.

4. Sign the Check

Review everything that you have written if they all tally. When there’s no discrepancy between the amounts and if the date is clear, sign the check on the space provided. And if the recipient is ready to go to the bank, give it to him. Just tell him to safeguard the check so it won’t get lost.

How to Cash a Pay to Cash Check?

Cashing out pay to cash check is the same as cashing out a personal check or any other check. You have the option to cash it out right away, or you can choose to deposit it in your own bank account.

Some banks are hesitant to cash out these types of checks. So, if you can first search for banks with no qualms about these checks so that you won’t be wasting your time while validating your check.

If you need the cash fast, you can go to check cashing companies. Some of these companies include 7-Eleven and Walmart. However, they may not honor handwritten checks.

Normally they cash out government checks and paychecks. It is best to find the bank’s nearest branch that issued the check and cash the check there.

How to Deposit a Pay to Cash Check?

If you don’t need cash at the moment, you can deposit the check into your bank account. Depositing it is just like depositing a check written with your name on it. Just go to your bank, and fill up the check deposit slip with all the required information and give the slip and the check to the teller.

Alternatives to Pay to the Order of Cash Check

Instead of writing pay to cash check to transfer funds or pay somebody that you don’t know, there are other alternatives that you can use.

- If you are paying two people and you’re not sure who will be the one to cash the money from the bank, write their names with ‘or’ or ‘and/or’ in between their names. In this way, either of the two can go to the bank and get their cash; and

- You can also write out the check to your name if the people you are paying are not in complete agreement. Then cash out the money and pay these people. It will take some effort for you to do this, though. But you are sure that the right amount of money gets to the right people.

Conclusion: Pay to the Order of Cash

A check that says ‘Pay to the order of cash’ means that anybody can cash or deposit it in the bank. A check doesn’t have to have a specific name for it to be cashed or deposited by a person.

When the word ‘cash’ is written on the check instead of a name, it means the bank should give the amount indicated therein to anyone who presents it to the bank teller.

To write pay to the order of cash check, fill in the details required, such as amount, date, etc., then put “Cash” on the name field.

Related reading:

Can You Deposit Someone Else’s Check in Your Account

Can You Cash a Check at an ATM?

Can You Buy Something with a Visa Gift Card and Return It for Cash?

![Awaiting Fulfillment [What Does This Mean on Your Order Status?] awaiting fulfillment](https://howchimp.com/wp-content/uploads/2021/06/awaiting-fulfillment-300x200.jpg)

![Read more about the article How Much Does It Cost to Print at FedEx? [Print and Go Cost]](https://howchimp.com/wp-content/uploads/2021/04/how-much-does-it-cost-to-print-at-fedex-300x200.jpg)