It’s not always easy to look for a job. That’s why some job hunters seek help from work agencies. The agency can help them find a job, wherein they will work by a W2 contract. What is a W2 contract?

A W2 contract is a contract between an individual under an agency or staffing company and another business. The individual or a W2 contractor has to work for the other company.

The company pays the work agency for the services that the W2 contractor renders. Then, the work agency pays the W2 contractor and acts as their employer.

Read on to learn more about the W2 contract meaning, including the details included in a W2 form and the difference between W2 contract workers from other types of workers.

W2 Contract

A W2 contract means a contract signed by a worker, their work agency or staffing company, and another company. The worker or W2 contractor has to work under the other company.

Then, the company pays the work agency for the services that the W2 worker renders. Then, the work agency pays the W2 worker and acts as their employer.

Basically, if you are a W2 contractor, your company’s tasks are the same as that of a full-time or regular employee. In the eyes of your co-workers, who are regular employees, you are generally like them.

The difference lies in the fact that you are a temporary employee and work on a contractual basis.

Difference Between W2 Contract Workers and Regular Employees

If you’re under a contract, W2 means you don’t get to enjoy benefits like regular employees. You may be working for the same company, but your employer is your work agency. The work agency is the one that gives you your salary and deducts the necessary taxes.

It is possible for the company you are working for to provide some benefits such as health insurance. However, that is not the case all the time. The company has the option to provide it or not.

Between a W2 and a regular employee, the latter is generally in a better position. Firstly, a typical employee’s status in a company is more secure than a W2 worker’s quality. Secondly, a regular employee enjoys more benefits than a W2 worker.

However, there are also several advantages to being a W2 worker. One of which is the opportunity to develop new skill sets and improve existing skills. A W2 worker can become a more flexible worker than a regular employee.

What Should You Know About the W2 Form?

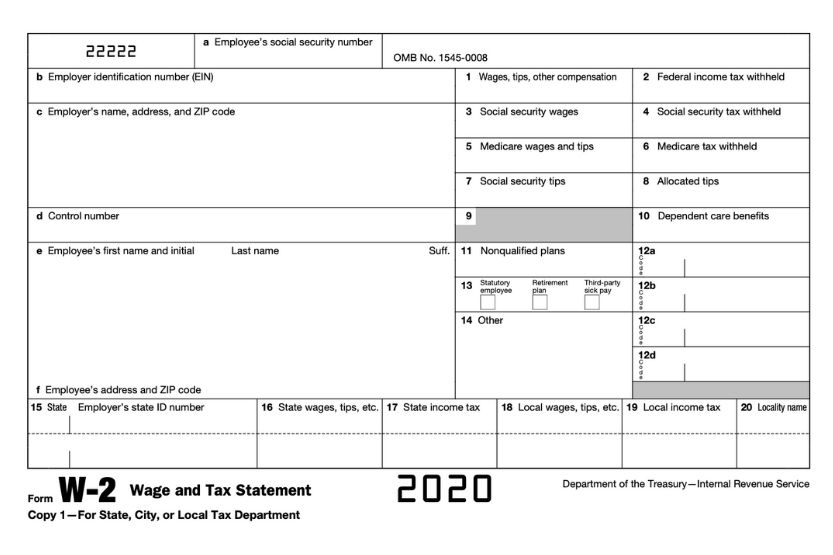

The term “W2 contract” is from the W-2 Form. It is a statement that an employer must prepare on an annual basis for employees.

Details indicated in this form include the following:

- Total gross earnings

- Social security earnings

- Medicare earnings

- Federal and state taxes withheld from the employee

This form provides employees with details that they must indicate in their income tax form. The document also allows the Internal Revenue Service (IRS) and the Social Security Administration (SSA) to validate employees’ income tax returns.

Employers must release the W2 form of employees by end-January. For instance, if the report entails employee income for 2020, employees must receive their W2 form by January 31, 2021.

You should send a copy of the W2 form to the SSA on the same date. If employers release the W2 form to their employees on January 31, 2021, they must also release copies for the SSA on January 31, 2021.

Other employers release the employees’ copy in the first week of January. That way, there will be time to double-check the details and correct errors, if any.

W2 Form Sections

A W2 form has several sections and parts, each of which has to do with a particular institution.

Each section is labeled A, 1, B, C, 2, and D.

Note that you should release Part A to the SSA while giving Section 1 to the city, state, or locality. Meanwhile, ask your employer to send Copy B with their federal tax return, while Copy C must form part of the employee’s records.

Like Copy 1, you should give Part 2 to the city, state, or locality. In contrast, Copy D forms part of the employer’s records.

Where to Obtain W2 Forms?

It is not advisable to generate the W2 form from the internet since Copy A requires a particular paper. The official documents are available at copy shops or your tax preparer. You may also check out legit tax software programs that you may use.

However, this should not be a concern among employees. The company must be responsible for obtaining the form.

Filing W2 Forms with Social Security

If the employer is filing W2 forms with the SSA, this may be done in two ways. The first is by mail, and the second is online:

By Mail

Employers may send copies to the SSA by mail. However, they have to include a W3 form, which serves as a transmittal form, indicating a summary of all the W2 documents for submission.

Via Online

While employers may file by mail, the SSA nonetheless prefers online filing. Employers need to visit the Business Services Online site owned by the SSA to register and complete the filing process. Also, W3 forms are not required anymore when filing W2 forms online.

Information Needed to Submit W2 Forms

To submit W2 forms, employers need details about the following:

- Business

- Employees

- Employee Earnings

- Retirement Plans

- Special Benefits

Information about the business include the following:

- Business Name

- Business Address

- State Tax ID Number

- Employer ID Number

Details about the employees need to be updated too. These include the following:

- Name

- Address

- Social Security Number

- Tax Identification Number

When it comes to employee earnings, details needed are the following:

- Total wages, tip income, and all other compensation

- Full Social Security wages

- Total Medicare wages

- Social Security and allocated tips

In Box 12 of the W2 form, details about the retirement plan must be indicated. The employer must tell which employees participate in a retirement plan and which are not qualified.

Other details are also indicated, such as if the worker is a statutory employee or received third-party sick pay.

Details regarding unique benefits are indicated in Box 13 of the W2 form. These include details about deductions related to employee benefit plans and other deductions required to report the income tax return.

The SSA prefers employers to file online because there are extensive guidelines for every item. These guidelines will help them accomplish the forms efficiently.

Difference Between W2 Contract Employees and 1099 Employees

If there are W2 contract employees, there are also 1099 employees. Let’s discuss the difference between them:

W2 Contract Employees

Employers have contract W2 forms for all their regular employees. By default, regular employees are categorized as W2 employees. You might be wondering why “W2 contract employees” are called as such when they are only considered temporary employees.

This is basically because W2 contract employees function similarly to any other regular employees. Both types of employees may even have similar work schedules. W2 contract employees are subject to tax too.

However, they are filed by the staffing or work agency and not by the company to render their services to. The term “W2 contract employees” is used to distinguish them from 1099 employees.

A W2 contract is entered into by an individual, their work agency or staffing company, and another company. The individual, also called a W2 contractor/worker/employee, is then contracted to work for the other company.

The company pays the work agency for the services that the W2 contractor renders. Then, the work agency pays the W2 contractor and acts as their employer.

Generally speaking, the work agency acts like a middle man of the company and the W2 contract employee.

What is a W2 contract? A W2 contract means a contract between an individual under an agency or staffing company and another business. So, the individual or a W2 contractor has to work for the other company.

The company pays the work agency for the services that the W2 contractor renders. Then, the work agency pays the W2 contractor and acts as their employer.

Next, let’s look at what 1099 employees are.

1099 Employees

A 1099 employee is an independent contractor. In general, he provides specific services and does not perform tasks typically done by a regular employee.

He has the option to work for one company for one particular project at a time. But he may also accept multiple projects from the same or another company.

Suffice it to say, and a 1099 employee falls under the self-employed category. He is a business owner himself or a freelancer, or a consultant.

The employer hires a 1099 employee for a specific period of time. Moreover, the worker gets a fixed payment. There are times when a 1099 employee fails to complete the project within the timeframe stipulated in the contract.

In which case, he will either be paid the same amount, or a fine will be imposed. The terms and conditions outlined in the contract are the basis.

Since he is an independent contractor, a 1099 employee has the option to hire additional workers. Ideally, the hired workers would help him complete the project efficiently. He is also responsible for their wages.

A 1099 employee is not eligible to receive benefits enjoyed by regular employees. As an independent contractor, he must get their own health insurance. The company that hired him is not responsible for providing him insurance and other benefits like overtime pay and paid time off.

Distinguishing W2 Employees from 1099 Employees

Sometimes, employers don’t know whether they should hire W2 contract employees or 1099 employees. In other words, most employers are yet to figure out if hiring independent contractors is better than hiring workers from a staffing company.

If a company hires workers through an agency, payment is made per head. In other words, if you hire 3 workers, there are also 3 different transactions to process.

However, if a company hires one independent contractor, there is only one transaction, and the process is less tedious and not that complicated. Regardless of how many workers the independent contractor hires, the company only processes one transaction.

But each company has different needs. Perhaps, hiring independent contractors is feasible to some but not to others. If you are an employer, it is better to weigh the pros and cons first before deciding whether to hire W2 contract employees or 1099 employees.

Conclusion – What Is a Contract W2?

A W2 contract refers to a document signed by a worker, their work agency or staffing company, and another company. The worker, also called a W2 contractor, works for the other company.

The company pays the work agency for the services that the W2 worker renders. Then, the work agency pays the W2 worker and acts as their employer. This type of employee is called as such to distinguish them from 1099 employees.

The term “W2 contract employee” basically originated from the form called W-2 Form. It is a statement that an employer prepares on an annual basis for its employees.

The tax-related details in the form are the following:

- Total gross earnings

- Social security earnings

- Medicare earnings

- Federal and state taxes withheld from the employee

Companies hire W2 contract employees and give them tasks similar to that of regular employees. The primary dissimilarity lies in the fact that W2 contract employees do not benefit from routine employees.

Companies hire 1099 employees for special projects. An example of this is a digitization project. This project is not part of the daily tasks of a company’s regular employees.

Instead, the project, when completed, will then make the company’s daily operation more efficient. 1099 employees are basically hired because of their exceptional expertise that regular employees can’t generally perform.

A company has the option of whether they want to hire W2 contract employees or 1099 employees. Whichever the company chooses, the important thing is that hiring either type of employee will effectively help address its needs and meet business goals.

Related reading:

Currently Employed – How to Get a Job If You are Still Employed

How to Respond to a Job Interview Email? [Plus Sample Email]

![Read more about the article Walmart Customer Service Desk Hours [Open and Close]](https://howchimp.com/wp-content/uploads/2021/02/Walmart-customer-service-desk-hours-300x200.jpg)