PAYPAL INST XFER – what does this charge mean? If you’re confused by this charge, you’re not alone because a lot of people complain when they see it on their bank statement or bank account history. In this article, I will describe what this charge is and how you can deal with it.

What is “PAYPAL INST XFER” that appears on a bank statement? If you see this PayPal charge on your bank account statement, it means you have used PayPal’s instant money transfer option.

When you do a normal transfer from PayPal to your bank, it can take up to three to five business days to receive it.

The instant transfer option that you apparently used lets you transfer money instantly to your debit card. However, there is a charge to do this instant transfer. The charge is 1% of the total transaction or a maximum of $10.

Currently, PayPal’s latest instant transfer option for banks is only available in the United States. But they may roll out this feature in other countries as well.

Read on to learn more about the Paypal inst xfer (instant transfer) charge from PayPal in your bank account statement and what you can do about it.

What Is PAYPAL INST XFER?

PayPal account holders can use this PayPal feature if they urgently need to transfer or send money to another person or pay for merchandise. It offers a very quick and convenient way for PayPal users to pay for something they bought.

But you must be aware that there will be a certain service fee every time you use this feature. In other words, it is not a free option that you can use every time you need it. The charged fee is typically about 1% of the total transaction.

At this time, this is the maximum fee that PayPal charges for this feature. Whether you use your debit card or you use your bank account to send money, PayPal has a way to debit the fee from your bank account. This charge will then appear on your bank statement or bank history as a withdrawal – PAYPAL INST XFER.

PAYPAL INST XFER – How It Works

The minute you pay for something with PayPal, but there are not enough funds in your PayPal account, PayPal will access an alternative funding source to get the funds. The default source is typically your bank account. You can also opt for your credit card, but you have to change the funding method every time you use it.

How does Instant transfer in PayPal (PayPal Inst Xfer) really work? As the name implies, you can make a payment or send money instantly using this PayPal feature. The money is immediately credited to the seller while the money transfer is still being processed. There is no waiting time, and there is no wasted time involved.

To be able to use this option, you must have a confirmed U.S. bank account. You are also required to have a backup funding source like a credit card or a debit card. These cards should be registered on your PayPal account.

If, at first, your bank declines your payment, PayPal will attempt to reclaim the money. But if it fails to retrieve the money for the second time, PayPal will charge the payment to your backup debit card or credit card and will charge your account with the Instant Transfer fee.

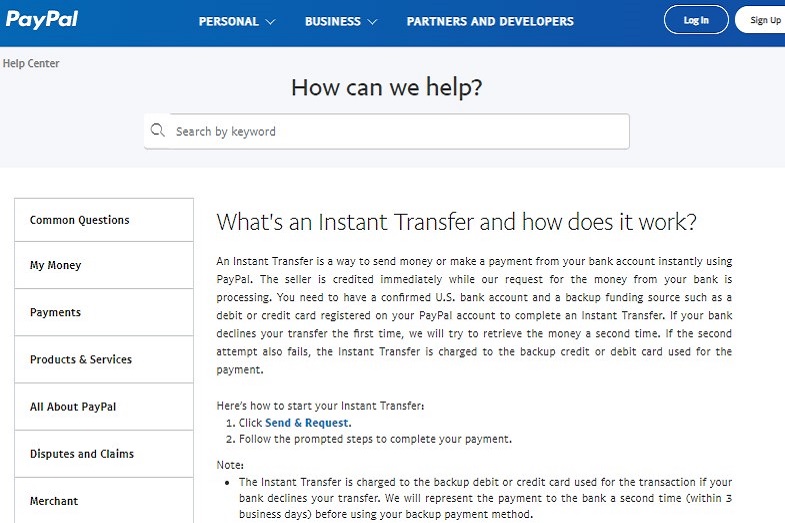

PayPal has provided the instructions below to help you understand the process of starting an Instant Transfer.

1. Visit PayPal’s Help Center

You can see how PayPal instant transfer works here and click “Send & Request.” Or you can sign in to your PayPal account and click “Send & Request.”

2. Follow the Steps Provided and Complete Your Request

Please understand that when you choose this feature, you agree to the following arrangements:

- Your Instant Transfer will be charged to your backup credit card or debit card to complete the transaction if your bank declines your money transfer. Within three days, PayPal will reclaim payment for the second time from the bank using your backup payment options.

- The source of your backup payment will be charged before the Instant Transfer is sent, not after.

- PayPal will email you and your recipient after the success of the transaction.

- You need to have sufficient money in your bank or backup payment sources before requesting an Instant Transfer.

- If the debit card or credit card enrolled in your PayPal account is expired, you will not be able to complete an Instant Transfer request.

- There is no hold if the payment has already been completed from your bank to PayPal. The money will reflect in your PayPal balance after payment is complete.

How PayPal Instant Transfer Sends Money Using Your U.S. Bank Account

If you are surprised with the Instant Transfer charge on your bank account, perhaps you had forgotten that you opted for this feature when you sent money to somebody. It pays to remember your PayPal transactions every time.

When you request and send a PayPal Instant Transfer, your money will be transferred safely from your bank account to the PayPal account of the recipient. Your recipient will not see your bank account. They have no way of knowing what bank you are using.

Here are the usual steps followed on PayPal’s Instant Transfer payments:

- Visit PayPal here and click “Send & Request”. Or you can sign in to your PayPal account and click “Send & Request”.

- Type in the email, name, or mobile number of the recipient, and then click Next.

- Type in the recipient’s name and the amount of your payment, and then click Continue.

- Click Change.

- Select Instant Transfer.

- Click Continue.

- Check the information. If they are all correct, click Send Money.

Sending money from your bank account may not be possible in some countries. So, check with PayPal before initiating this process.

Is PayPal Instant Transfer a Scam?

A lot of people wonder why the “Withdrawal PayPal Inst Xfer” charge appears on their bank accounts when they can’t remember using it. Probably, they just forgot about it. They are reticent in thinking that it could be a scam.

Please remember that you are bound to encounter this problem when you are using the internet for money transactions. The problem is not just with hackers. It is more serious if it is the actual company that does the scamming.

Fraudcreditcards.com claimed that they detected the Instant Transfer feature of PayPal in their DB (database), the number 4628. The charge came from the United States. Apparently, 20 individuals accessed their website, inquiring for Inst Xfer for PayPal or some similar thing.

It seems that they have also found this scam in Benin, Kosovo. They claim that their combinate score with Visa indicates that it has a 71% charge fraud rate. Apparently, a lot of credit card brands are being used as well.

In this respect, this website adds that it is a 72% credit charge fraud rate for PayPal and MasterCard and other credit card providers like Bank of America, Citigroup, JPMorgan Chase, Wells Fargo, and many more.

I am not saying that this is factually true. My point is that you really need to be aware of your online financial transactions. It is very convenient to pay for something immediately. But in order to do that, some processes are involved. And they cost money.

Advice from Fraud.org

If you are already wrestling with this problem, Fraud.org advises you to do the following things:

- Visit the official Fraud.org website.

- Study and learn from their tutorials. You can also contact them directly about your problems.

- Visit the official website of your credit or debit card brand, such as MasterCard or Visa, and ask for help or lodge a dispute on PayPal Instant Transfer charge.

We’ve answered the question, “What is PAYPAL INST XFER?” But how about “ACH HOLD PAYPAL INST XFER”? What does it mean?

What Does “ACH HOLD PAYPAL INST XFER” Mean?

If you see the message “ACH HOLD PAYPAL INST XFER” on your bank statement, it simply means that a payment you have already authorized is about to be deducted from your account. It is actually a notice that your payment is not on the other account yet.

It is a way by which your bank places a hold on the money in your account so that the amount will be available for settlement. When you see this ACH HOLD, it means your payment is about to be sent. You are no longer free to spend it as you wish.

You May Have Caused the PAYPAL INST XFER Charge Without Knowing

If you want an item, you want it delivered fast. It is not good to wait for days on end when you already have the money to pay for it.

That’s the main confusion with the PayPal Instant Transfer feature. The problem is you might have forgotten that you had opted for this feature when you ordered an item with immediate delivery.

PayPal’s Instant Transfer option enables you to instantly transfer funds from your bank account to another person’s bank account for a small fee. It is actually an extension of PayPal’s existing instant money transfer option that Venmo and PayPal have offered since 2017.

Venmo, as you know, is a subsidiary of PayPal. If you use this feature, PayPal will charge your bank account 1% of the total transaction. The maximum charge per transaction is $10. Like any other money transfer, the time varies and may take up to 30 minutes to clear.

At any rate, it is still faster than waiting up to three days before you receive the item you ordered. Currently, this feature is only available to PayPal account holders in the U.S. Bill Ready, COO of PayPal, stated in a TechCrunch interview that they intend to roll out this feature to other countries as well.

When you choose PayPal Instant Transfer to pay for something or send money to someone, PayPal will access your U.S. bank account, and if there’s enough money there to cover the transaction, it will transfer your money to the PayPal account of your recipient – in as short as 30 minutes.

To ensure that the transaction will push through, PayPal requires you to enroll backup fund sources to your PayPal account. In other words, you have to register your credit card or debit card from U.S. banks. If your original payment option doesn’t clear, PayPal will automatically use your backup money sources.

So, if you see this PayPal Instant Transfer charge, you must have used it to pay or send money to someone urgently in the recent past.

Check with PayPal If There Is Any Doubt

If you think someone is using your account without your knowledge, PayPal instructs you to inform them immediately. But before notifying PayPal, be sure that the ‘questionable’ charge is not the result of a transaction that you have simply forgotten.

If you are sure that it is an unauthorized transaction, call PayPal’s customer service at (402) 935-7733.

Another Way to Cancel PAYPAL INST XFER

This issue is quite easy to resolve if you will use the Truebill app. With this app, you can cancel PAYPAL INST XFER. On average, users of this app can save $512 a year from unwanted bank charges.

This app will help you cancel unwanted bills, monitor any changes, and track your subscriptions. To stop unwelcome bank charges, download this app on your device.

Conclusion – PAYPAL INST XFER

What is the meaning of WITHDRAWAL PAYPAL INST XFER? If you see this charge on your bank account statement, it means you have used PayPal’s instant money transfer option. Maybe you had to send money or pay somebody urgently, so there was a need to move money instantly to your debit card.

Every time you use this option, there will be a certain fee. PayPal charges this fee for instant transfers, whether they are to a debit card or a bank. Typically, the charge is 1% of the total transaction, with a maximum of $10.

If you see the message “ACH HOLD PAYPAL INST XFER” on your bank statement, it simply means that a payment you have already authorized is about to be deducted from your account. It is actually a notice that your payment is not on the other account yet.

It is wise to keep abreast of your PayPal money transactions so that you won’t be surprised by the charges that will appear on your bank account statements. As you may well know, everything in this world costs money. So always keep a tab on where you are spending yours.

![Uber Charged Me Twice [Uber Double Charge / When Does Uber Charge?] uber charged me twice](https://howchimp.com/wp-content/uploads/2021/05/uber-charged-me-twice-300x200.jpg)

![Read more about the article Does DoorDash Take Cash? [DoorDash Payment Methods]](https://howchimp.com/wp-content/uploads/2021/01/does-Doordash-take-cash-300x200.jpg)